Towards Budget 2025-26: Economic Challenges and Political Imperatives

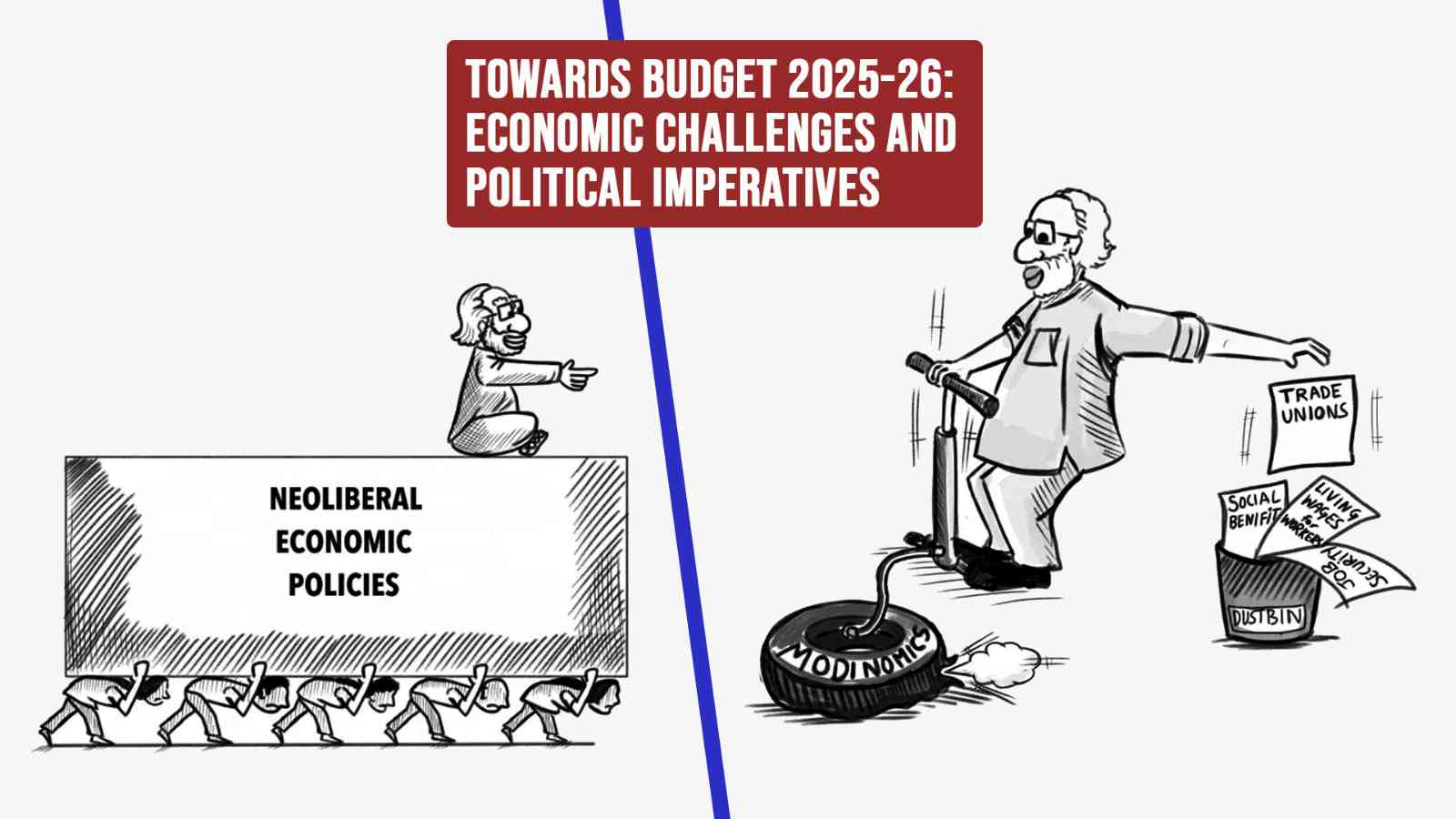

Ten years of corporate appeasement and economic mismanagement by the Modi government have pushed India into a deep economic crisis. From falling economic growth rate and relentlessly declining value of the rupee in relation to the US dollar to India's ever burgeoning import bill and soaring prices of everyday necessities, every indicator points to India's worsening economic conditions. To deflect attention from these alarming current parameters the government has shifted the goalpost to faraway 2047, making India a developed country by the centenary of India's independence! Meanwhile, the attempt to ensure corporate takeover of agriculture through farm laws having been defeated, this agenda is now being sought to be advanced by the proposed policy framework on agricultural marketing. On the labour front, the dominant discourse now revolves around lengthening the work week to as many as ninety hours even as wages continue to decline and working conditions grow ever more harsh, insecure and undemocratic.

The 'trickle-down' theory of economic development has been nothing more than a wishful fantasy even in the best of times. But with GDP growth itself becoming sluggish, the trickle-down claim becomes a cruel joke. During the second term of the Modi government, real wages for agricultural workers have continued to drop annually by 1.3 percent while non-farm rural wages fell at an even greater rate of 1.4 percent. A recent report prepared by FICCI points to declining real wages across the private sector between 2019 and 2023 - while nominal wages have grown at an annual rate of 0.8 (for EMPI sector covering engineering, manufacturing, process and infrastructure) to 5.4 percent (for FMCG or fast moving consumer goods sector), inflation has grown at the annual rate of 5.7 percent. Post-tax profits on the other hand have grown fourfold even in the post-covid phase, reaching a peak of 4.8 percent of GDP in 2024, the highest point in the last fifteen years.

The combination of declining wages and rising profits contributes to alarming levels of economic inequality with a small club of billionaires at the top controlling the lion's share of wealth and income. And this shocking inequality is reinforced by India's increasingly regressive tax system. India's tax to GDP ratio (around 17 percent including provincial and municipal taxes along with taxes levied by the Union government) is among the lowest in developing countries. Indirect taxes, with GST as the main component, contribute nearly half of total tax revenues while the share of personal income taxes now has overtaken corporate taxes in the direct tax component. In other words, the poor and the middle classes bear the brunt of the tax burden while the ultra rich gets away with very little contribution to India's tax kitty.

During his recent visit to India, renowned French economist Thomas Piketty dared the Government of India to make public the data of taxes paid by the richest 100 Indians. As suggested by Piketty and many other development economists, a one-time 2 percent wealth tax and 33 percent inheritance tax on wealth and inheritance above 100 milion rupees and a more effective income tax system for the ultra rich can greatly enhance India's revenues and create the financial base for universal delivery of quality education, healthcare and other essential public services. The claim of lower corporate taxes leading to greater private investment and employment generation has proved to be completely hollow. Chief Economic Advisor V Anantha Nageswaran has in some of his recent public utterances noted the paradoxical combination of growing corporate profits and declining employment and stagnating wages. The proportion of regular wage jobs has dropped by 5 percent between 2017-18 and 2023-24 while the share of self-employed workers has grown from 52 percent to 57.7 percent over this same period.

Another major concern is the relentlessly declining value of the rupee in relation to the US dollar. From ₹58 to a dollar in 2014, the value of the rupee has plummeted to ₹86 to a dollar over the last decade of Modi government. The declining value of the rupee has three major adverse implications – a soaring import bill, growing debt-servicing burden and flight of foreign institutional investment away from India on account of declining return in dollar terms. The BRICS countries have been expressing a collective resolve to achieve substantial de-dollarisation of international trade by promoting alternative currencies and ending the domination of the dollar as the core currency of global trade. But with Trump threatening to impose punitive tariffs to stop any attempt to conduct international trade in currencies other than the US dollar, Modi has already backed away from this alternative plan and initiative. The government has now also succumbed to American pressure to stop purchasing oil from Russia.

Declining wages and eroding purchasing power of the common people mean a downward pull in mass consumption and domestic demand. This slump in the home market has become a major deterrent to any effective growth in productive investment and manufacturing activities. The biggest economic priority for the government must be to increase public investment and ensure a significant increase in wages and purchasing power to boost domestic demand and production. And in the arena of international trade India must expand economic cooperation and coordination with other developing countries to put up a collective resistance to the economic domination and control of the United States and other advanced economies. This calls for the political will to tax the rich and defend the economic interests of India, as distinct from the interests of corrupt crony capitalists like the Adani group, in the global economic domain. The Modi government has been pursuing precisely the opposite course of action and has thus become a growing economic liability for the overwhelming majority of the Indian people.

Charu Bhawan, U-90, Shakarpur, Delhi 110092

Phone: +91-11-42785864 | +91 9717274961 E-mail: info@cpiml.org